Precision Performance

Calculation Simplified

Attruvia Lite is a web-based performance engine for asset managers, family offices, and wealth management firms. It streamlines performance calculations with the Modified Dietz method and provides deep investment insights through automated modeling, interactive dashboards, and benchmark comparisons.

How it Works

Data Configuration & Load

Define file formats, map transaction codes, and load data for calculations.

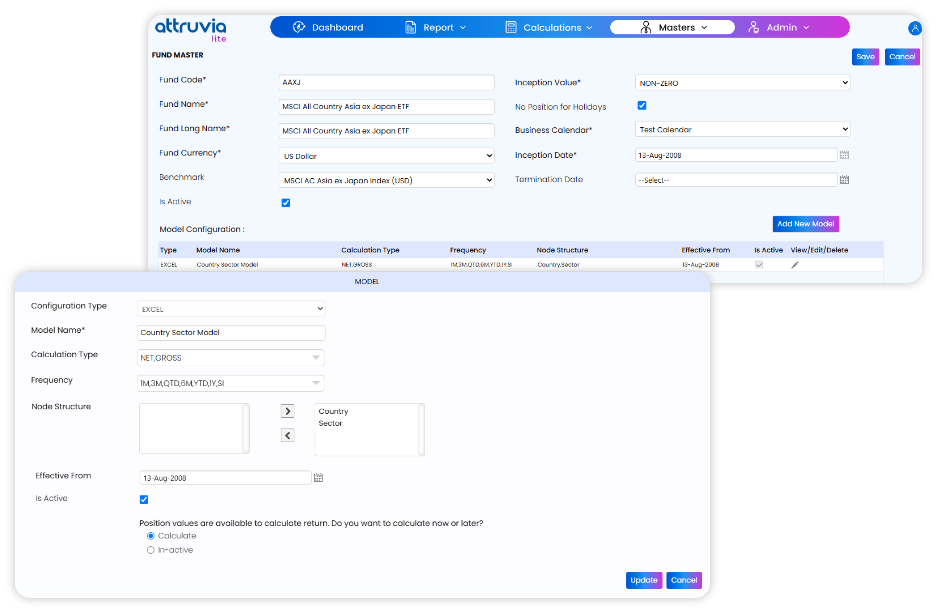

Fund Creation

Set up and manage investment funds with hierarchical classifications.

Model Mapping

Assign performance models to funds and inherit classification structures.

Reporting

Generate detailed performance reports with breakdowns at fund, sector, and security levels.

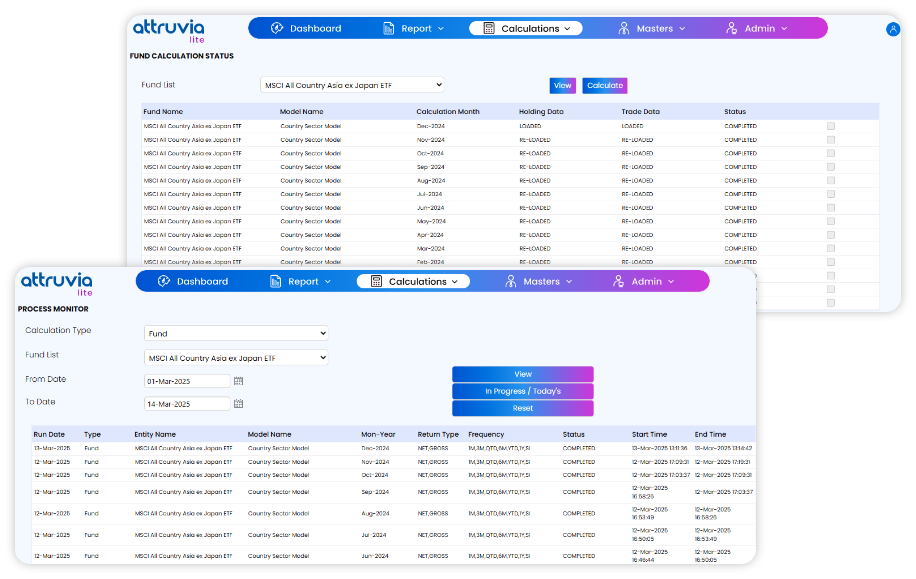

Performance Calculation

Compute portfolio returns using the Modified Dietz method.

Features

Performance Calculation

Calculation Methodology

- Uses Modified Dietz to provide accurate time-weighted returns.

- Supports both transaction-based and holdings-based calculations.

- Multi-level attribution at Total, Country, Sector, and Security levels.

Performance Contribution Analysis

- Identifies the impact of various investment decisions.

- Supports both absolute and relative return calculations.

- Compares portfolio performance against benchmarks in Attruvia version.

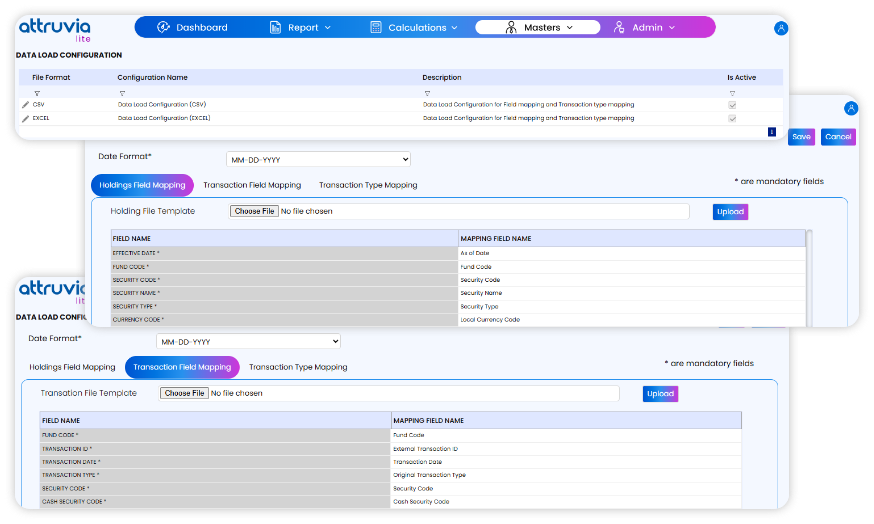

Seamless Data Integration

Data Load Configuration

- Supports two file types: Holdings and Transactions.

- File format configurability for seamless data ingestion.

- Transaction Codes Mapping: Defines transaction types and assigns cash flow weights.

Fund Creation & Model Mapping

Fund Setup

- Allow users to create and manage investment funds.

- Hierarchical classification support (Country, Sector, etc.).

Model Mapping

- Enables users to link performance models to funds.

- Dynamically inherits classification rules from Data Load Configuration.

Advanced Reporting & Dashboards

Comprehensive Performance Reports

- Breakdown of Returns, Weights, and Contributions.

- Reports available at Fund, Country, Sector, and Security levels.

- Export reports in multiple formats (Excel, PDF, etc.).

KPI Dashboards

- Visual representation of key performance metrics.

- Drill-down functionality for deeper analysis.

Use Cases

Attruvia Lite provides a structured and efficient framework for performance analysis, catering to diverse financial professionals. The platform enables accurate return calculations, seamless data integration, and dynamic reporting, ensuring informed investment decisions.

Family Offices

A comprehensive report to understand risk-adjusted returns.

Asset Management Firms

Analyze fund performance across various asset classes and compare with benchmarks.

Wealth Management Firms

Track contributions of different sectors in a high-net-worth portfolio.

Benefits

Accuracy

Utilizes the Modified Dietz method to ensure precise return and attribution calculations, accounting for cash flows and market movements effectively.

Automation

Streamlines data integration, model mapping, and calculations, minimizing manual intervention and reducing the risk of errors.

Customization

Offers flexible classification structures, allowing users to define fund hierarchies, Sector mapping and benchmarks tailored to their needs.

Scalability

Designed to support multiple asset classes and complex fund structures, making it suitable for both small firms and large asset managers.

Frequently Asked Questions

How does Attruvia Lite handle large datasets?

Attruvia Lite is designed to process high volumes of financial data efficiently, ensuring seamless performance even with complex portfolios. It leverages optimized data structures to enhance speed and accuracy.

What are the minimum data requirements for calculations?

At a minimum, the platform requires:

- Portfolio transactions and holdings data

- Holdings data should be provided with classification details

- Benchmark data (if comparisons are needed)

How does Attruvia Lite ensure accuracy in performance calculations?

Attruvia Lite adheres to global performance standards (e.g., GIPS) and uses proven methods like the Modified Dietz and time-weighted return.

Does Attruvia Lite support benchmark comparisons?

Yes. The platform allows full benchmark integration at both the security and classification (e.g., sector/country) levels. It provides relative performance analysis against the Performance results

What reporting capabilities does Attruvia Lite offer?

Attruvia Lite provides comprehensive reporting tools, including downloadable performance reports and benchmark comparison report outputs. Reports can be consumed at multiple levels - fund, sector, security - and are exportable in formats such as Excel and PDF.